ABOUT PETROLEUM FUND

Timor-Leste’s constitution provides that the resources should be used in a fair and equitable manner in accordance with the national interests and the conditions, and also for the exploitation of the natural resources to lend themselves to the establishment of mandatory financial reserves. Accordingly, the Petroleum Fund of Timor-Leste was formed by the enactment of the Petroleum Fund Law Number 9/2005 promulgated in August 2005. The intent of the law is that the Petroleum Fund should contribute to the wise management of the petroleum resources for the benefit of both current and future generations. The Petroleum Fund is a tool that contributes to sound fiscal policy, where appropriate consideration and weight is given to the long-term interests of Timor-Leste’s citizens. The Petroleum Fund is coherently integrated into the State Budget and gives a good representation of the development of public finances. The Petroleum Fund is required to be prudently managed and operated in an open and transparent fashion, within its constitutional and legal framework.

Petroleum Fund Receipts

The receipts of the Petroleum Fund include revenues from any exploration and exploitation of petroleum and related activities. There is no point in having good investment management governance if the funds are not banked in the first place. Therefore, the Central Bank operates a special bank account at the Federal Reserve Bank of New York to receive all petroleum and petroleum-related revenues. By law, obligations to the state (royalties, taxes) are not deemed to be discharged unless the payment is deposited into this account.

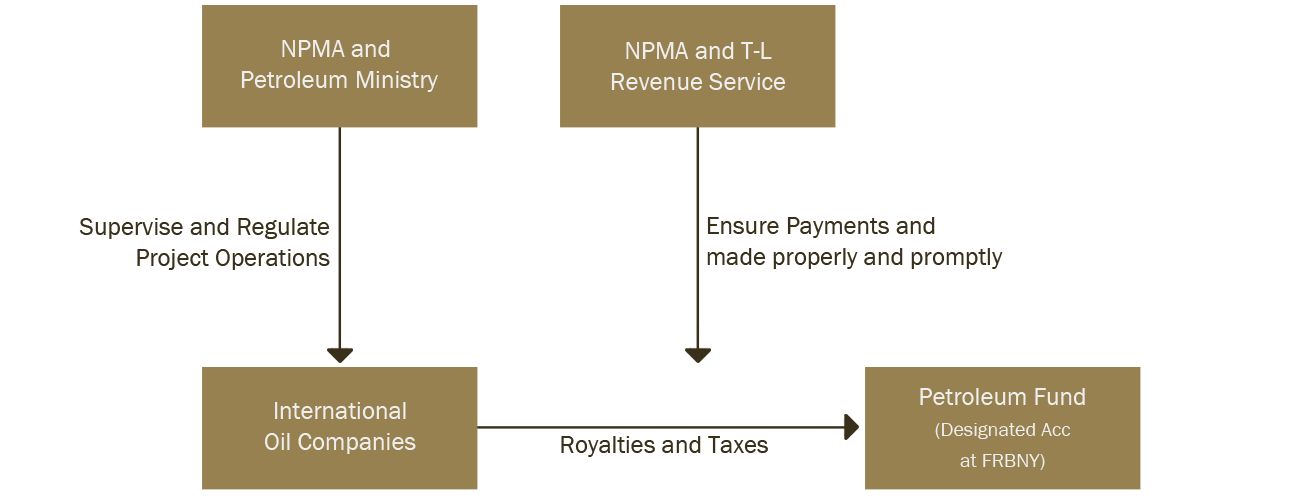

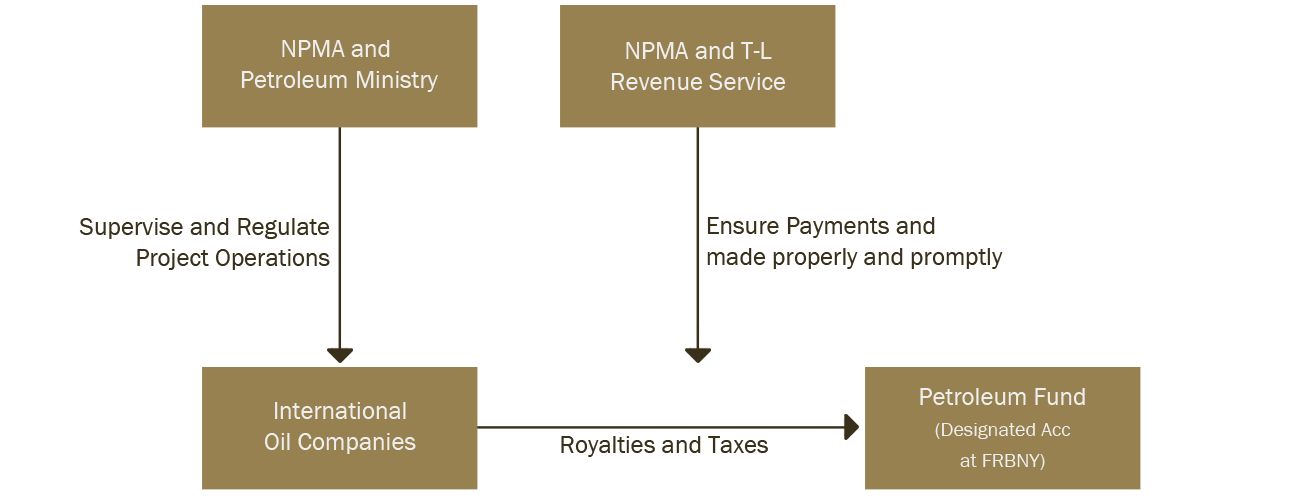

The process of project operations and revenue collection is shown in Chart 1, where the National Petroleum and Minerals Authority (NPMA) and Petroleum Ministry are responsible for supervising and regulating the project operations of international oil companies. The NPMA and Timor-Leste’s Revenue Service ensure payment of royalties and taxes are made properly and timely to the designated Petroleum Fund account at the Federal Reserve Bank of New York.

Chart 1: Revenue Collection Framework

Investment Objective, ESI & Transfers

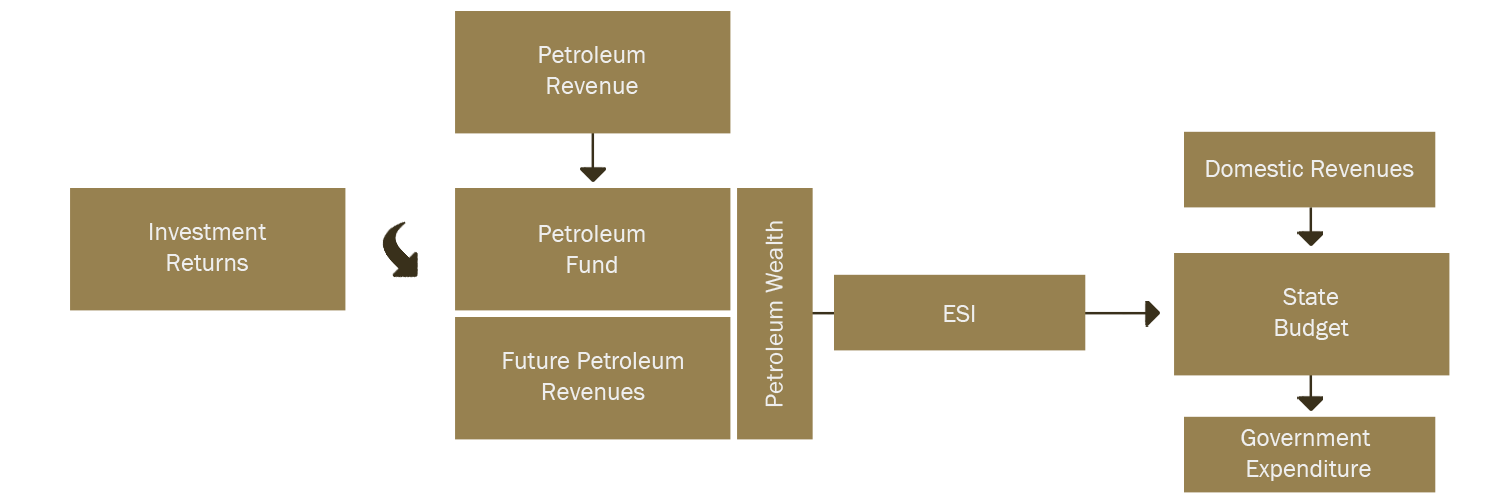

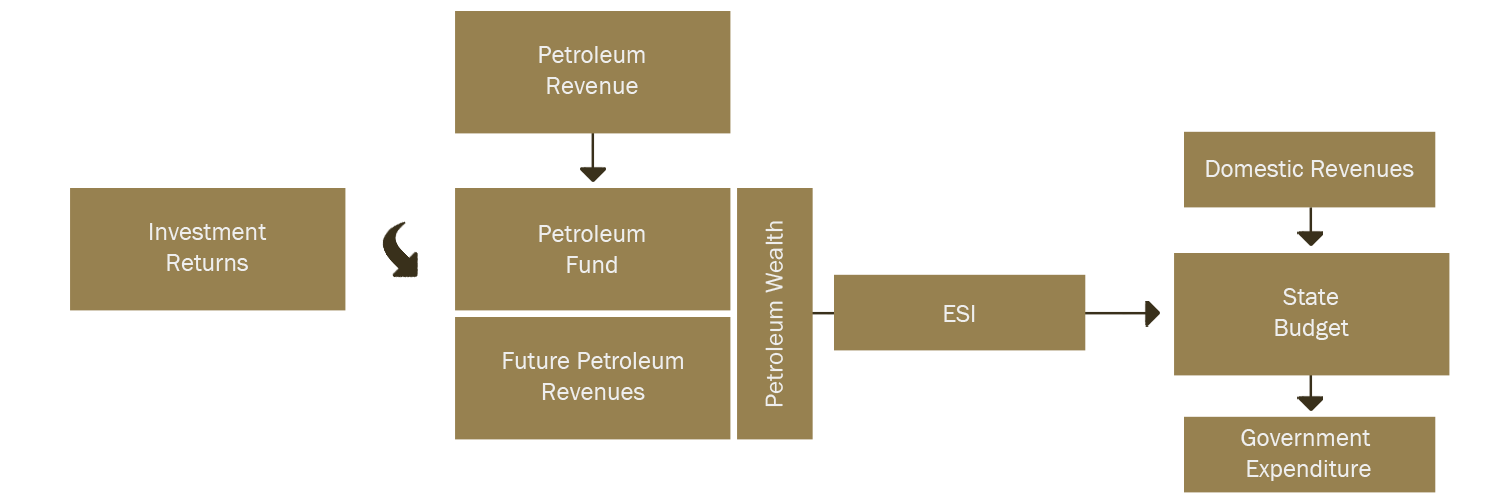

The Investment Objective of the Petroleum Fund is to invest the Petroleum Fund’s assets so that with a reasonable probability over the long term the Fund will be able to provide transfers to government at a sustainable level (Estimated Sustainable Income/ESI) while maintaining the real long-term value of the assets. The implied investment objective is to achieve a 3% real return. This aligns the investment policy with fiscal policy, as reflected in the ESI rule.

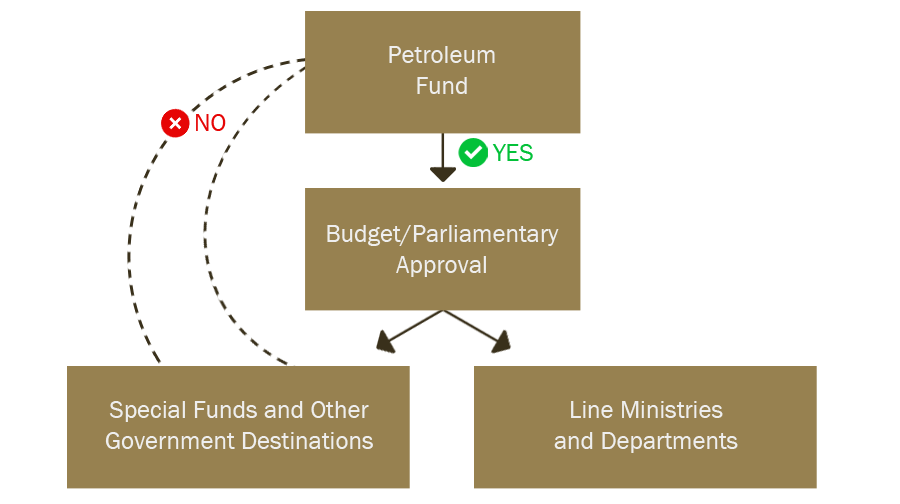

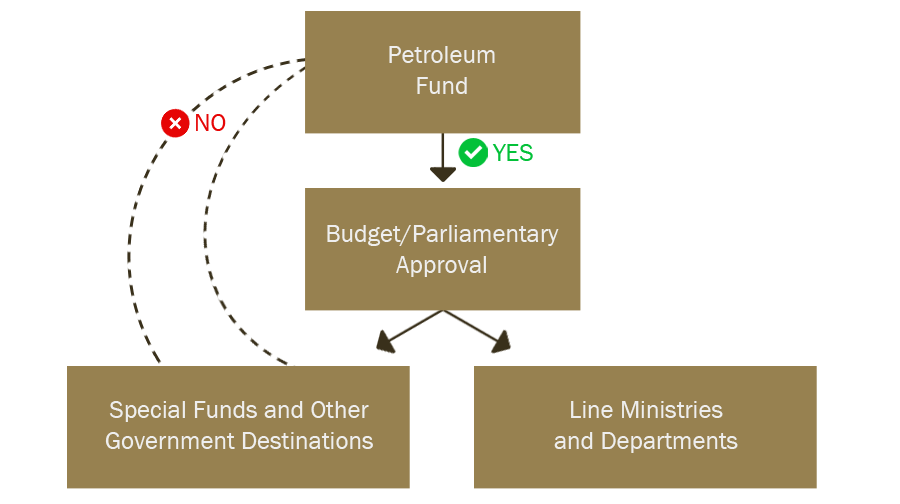

To control overspending in a small economy, the 3% Estimated Sustainable Income (ESI) is a measure of long-term sustainable withdrawals. The Petroleum Fund has financial objectives only, while economic development is taken care of by the State Budget. Transfers from the Petroleum Fund to the state budget must be appropriated by parliament and the transfers in any one year may not exceed the ESI. The Government may however transfer more than the ESI, subject to additional safeguards. Transfers from the Petroleum Fund are only permitted to credit the State Budget Account and to pay management fees to the Central Bank. Refunds of overpaid taxation are exceptionally permitted. The transfer’s framework is shown in Charts 2 & 3.

Chart 2: ESI Framework

Chart 3: Transfers Framework

Governance Framework

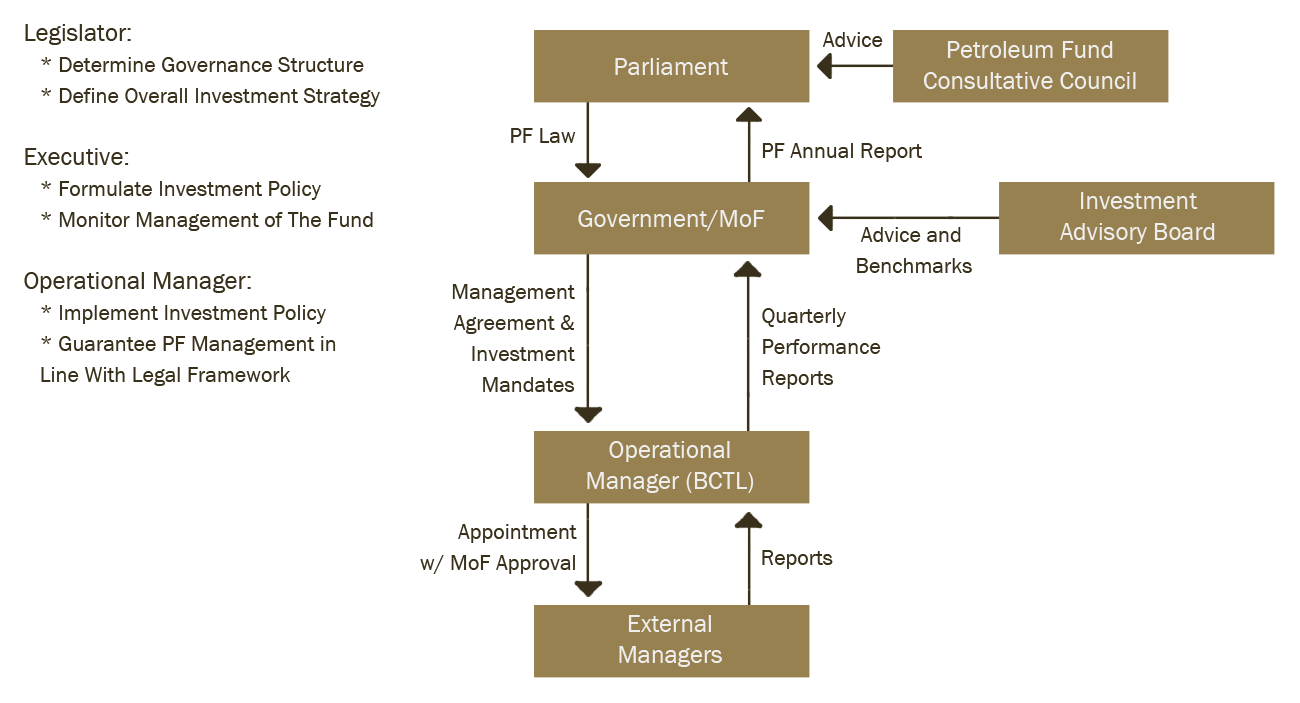

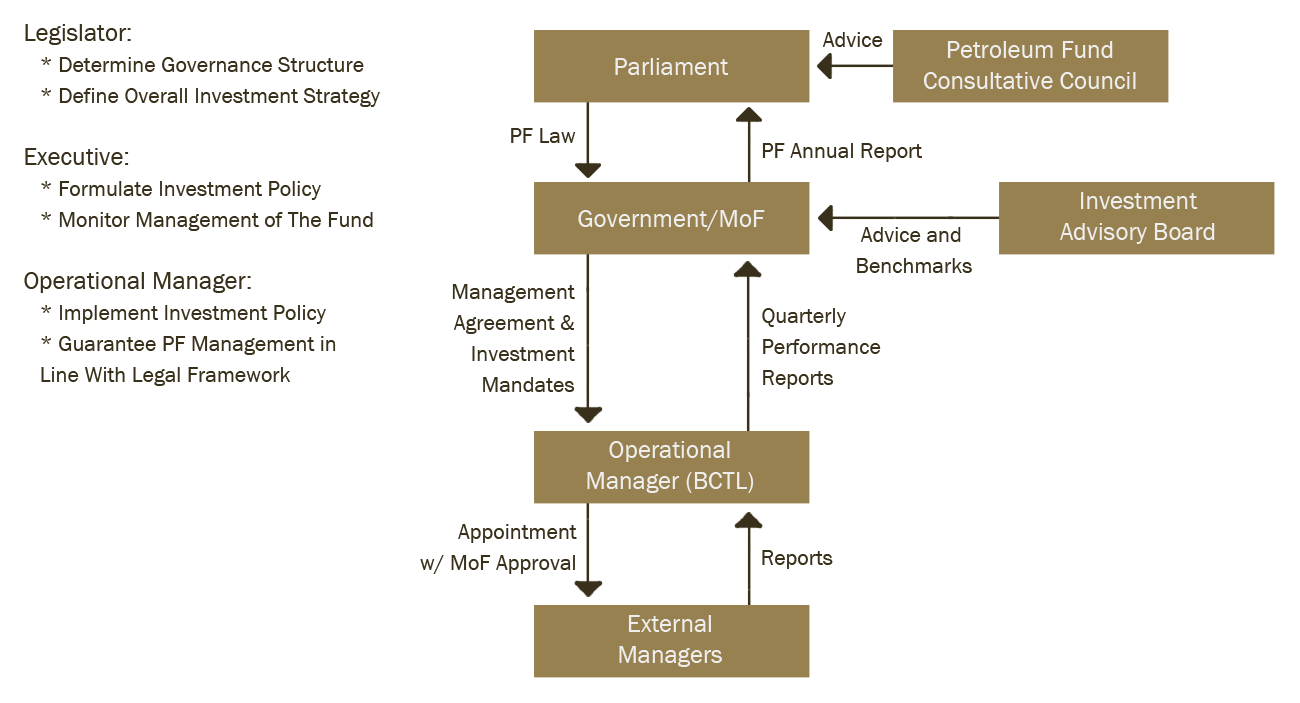

The management of the Fund spreads the decision-making process across various stakeholders to ensure prudent management with checks and balances. The law establishes the governance structure shown in Chart 4.

Chart 4: Governance Framework

As can be seen in the framework the ultimate authority is Parliament, which determines the governance structure and defines the strategic asset allocation in the petroleum fund legislation. The Government, represented by the Minister of Finance, is responsible for the overall management and investment strategy of the Petroleum Fund. The Central Bank of Timor-Leste (BCTL) is the operational manager responsible for operational management of the Petroleum Fund by implementing the investment policy determined by Minister of Finance. In doing so, the Central Bank ensures that the management of the Petroleum Fund is in line with the legal framework.

The Consultative Council provides advice and oversight to Parliament on matters related to the Petroleum Fund. The Investment Advisory Board is responsible for developing performance benchmarks for the Minister of Finance and advises the Minister on investment policy and the management of the Fund.

The Governance framework provides a clear division of roles to ensure good governance, stakeholder involvement, and prudent and transparent management of the Fund for the benefit of current and future generations. The governance structure is designed to prevent any one stakeholder from having control over the decision-making or management process.

Investments

The law gives the Central Bank responsibility to undertake the operational management of the Fund under a formal

management agreement with the Minister of Finance. A Management Agreement between the BPA (predecessor of Central Bank of Timor-Leste) and the Minister of Finance was signed in 2005, with a number of subsequent updates.

In order to qualify as an eligible investment, an investment must be issued or situated abroad in an internationally recognised jurisdiction. The initial investment universe prescribed by the law was 90% high quality fixed interest denominated in USD for the first 5 years from 2005-2010. There was provision to invest up to 10% in other liquid instruments traded in well-regulated markets.

The Central Bank commenced Petroleum Fund operations in August 2005 after an opening balance of $205 million was transferred by the Government. Up to June 2009, the entire Fund was managed internally by the Central Bank under a passive US Treasury mandate.

In June 2009, the first diversification of the Fund took place by appointing the Bank for International Settlements (BIS) as the Fund’s first external manager managing 20% of the Fund in international sovereign bonds. The mandate was subsequently restructured to focus on 5-10 year US Treasury bonds, and the size of the allocation was reduced to 10% of the Fund Value. This permitted diversification into a global developed market equity mandate from October 2010, with Schroder Investment Management Limited as the Fund’s first equity manager. This mandate was initially 4% (currently 5%) of the Fund.

This provided about as much diversification as the Petroleum Fund law permitted for the first five years of the Fund’s existence. Accordingly, the law was amended by law number 12/2011 in September 2011. The amended law requires that not less than 50% of the Fund be invested in fixed interest instruments, up to 50% may be invested in listed equities and up to 5% may be invested in other eligible investments. Following the amendment, the exposure to equities was gradually increased over a period of 18 months, with a total exposure of 40% to equities being reached in June 2014. As part of the diversification, a number of external equity fund managers were selected to manage approved mandates. A further diversification in Developed Market Global Sovereign Bonds ex US took place by selecting two global sovereign bond managers.

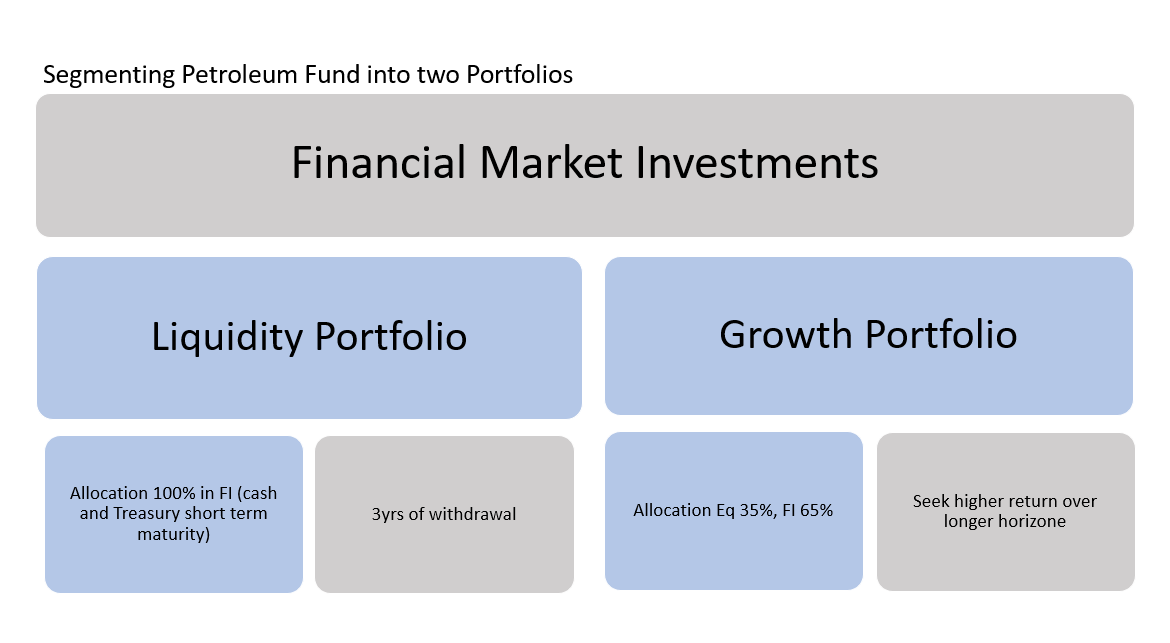

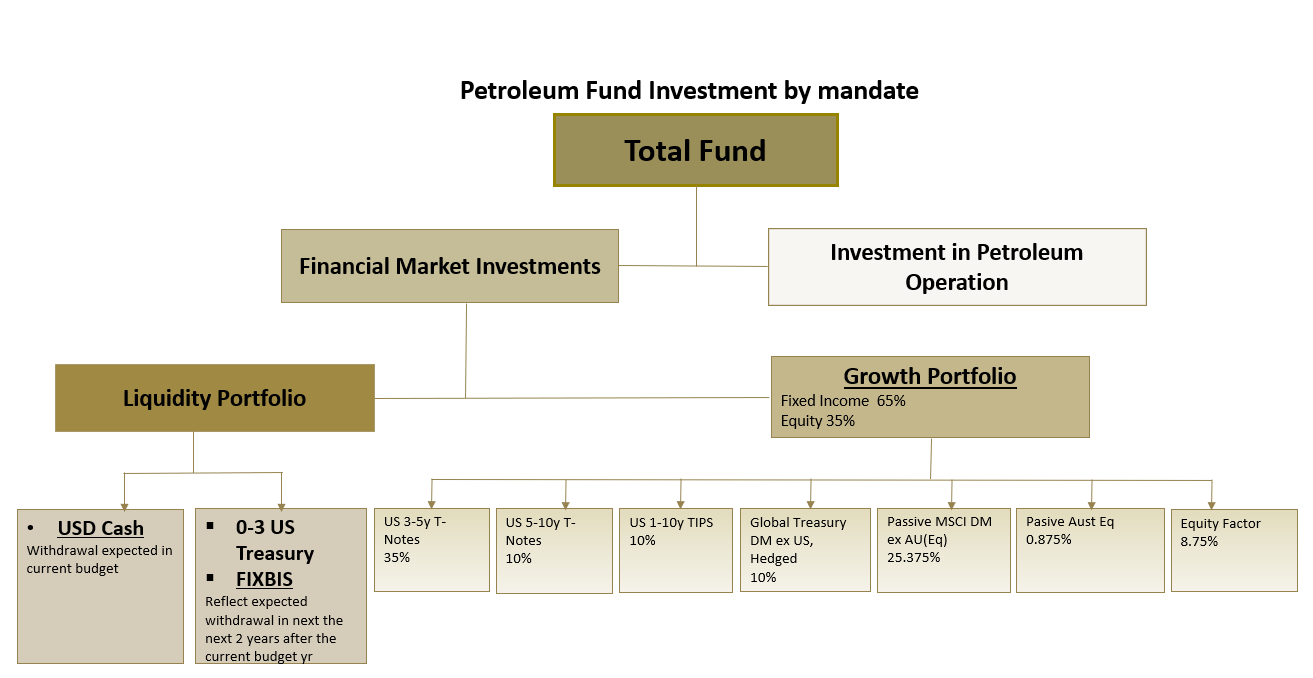

Financial Market Investments

The Fund’s Financial Market Investments are invested in offshore, financial assets – namely, fixed interest securities, listed equities and other eligible investments – that meet the criteria in the Petroleum Fund Law.

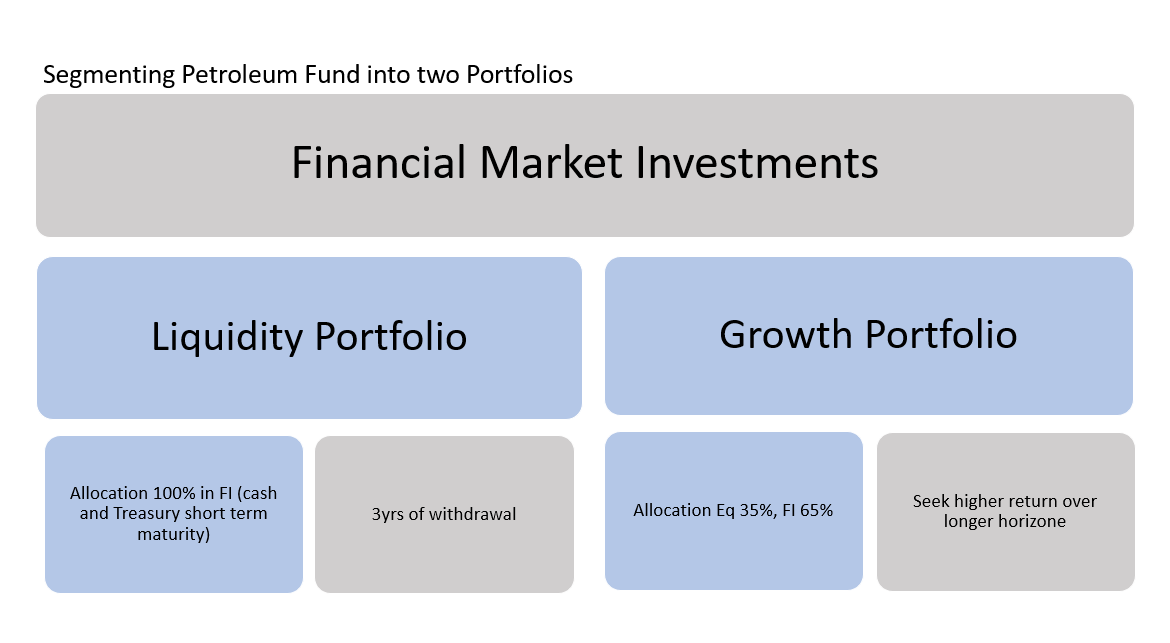

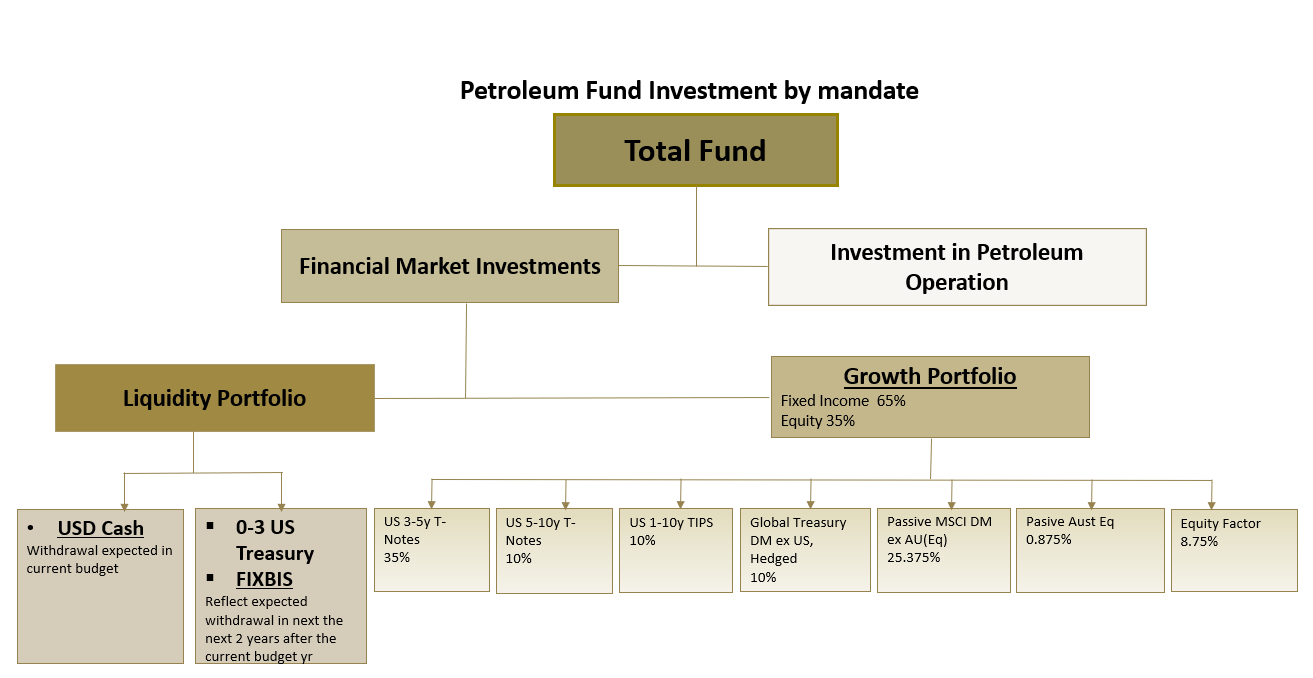

To address the anticipated decumulation of the Petroleum Fund, the Financial Market Investments are divided into two distinct portfolios: the Liquidity Portfolio and the Growth Portfolio. This segmentation was implemented in April 2021, with the Liquidity Portfolio benchmark updated in April 2024.

Liquidity Portfolio

The Liquidity Portfolio is designed to meet the Petroleum Fund’s withdrawal requirements. Each year, in the first quarter, the Ministry of Finance provides projections for withdrawals and determines the size of the Liquidity Portfolio. This portfolio focuses on short-term investments with a 0–3-year horizon, primarily to support the government’s state budget financing needs.

Growth Portfolio

The Growth Portfolio comprises the residual value of the Financial Market Investments after allocating funds to the Liquidity Portfolio. It is primarily invested in long-term bonds and equities to foster capital appreciation. Rebalancing occurs annually in the first quarter, with any remaining funds reinvested to optimize long-term growth.

The details of the mandates and benchmarks are shown in the table below as well as in the

Quarterly Reports published in this website.

To ensure transparency, the law requires the Central Bank to submit Quarterly Reports on the performance of the Petroleum Fund to the Minister of Finance, with the reports being published within 40 days of the end of each quarter. Copies of all reports are available on this website. The Petroleum Fund’s Annual Reports contain a more complete description on the Fund’s activities and its audited financial statements is published by the Ministry of Finance are available from the Ministry of Finance and the Central Bank. Enquires about the BCTL’s role in managing the Petroleum Fund should be addressed to info@bancocentral.tl

Updated: 13 August 2025