About FIU

The Financial Information Unit, abbreviated as “UIF”, is an administrative entity created within Central Bank of Timor-Leste under Law no. 17/2011 of 28 December, amended by Law no. 05/2013/III of 14 August, on the Legal Regime for Prevention and Combating Money Laundering and Financing of Terrorism.

Though the Unit is created within Central Bank of Timor-Leste it enjoys independence and autonomy in its operational management. The nature, organization and function is regulated under the Decree Law no.16/2014 of 18 June.

This Unit which officially started its operation in 26 of September 2014 is led by an Executive Director appointed by the Governor of BCTL for a term of 4 years, who shall fully responsible for the management and UIF daily operations

Vision

Contribute to a dynamic and solid financial and non-financial system which is free from money laundering and financing of terrorism

Mission

-

To be an independent and credible center, supplying high quality intelligence reports to UIF partners; actively promote public awareness raising program concerning related topics, prioritising reporting entities to ensure their compliance with applicable legal obligations; and promote effective domestic and international cooperation in the fight against money laundering, terrorist financing and associated predicate offenses.

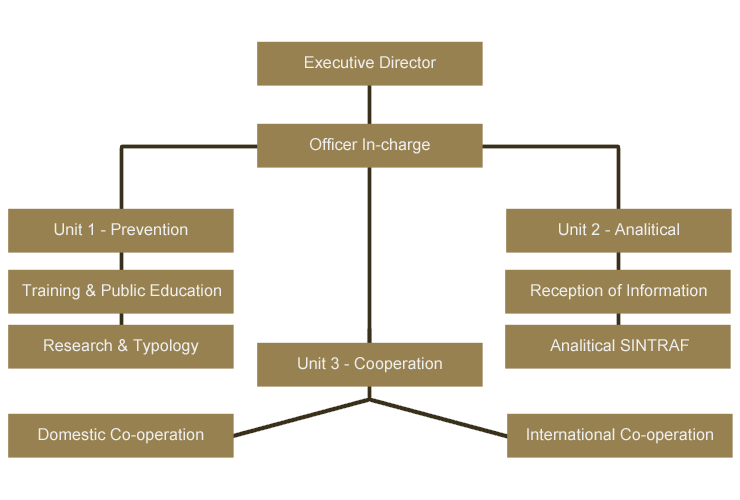

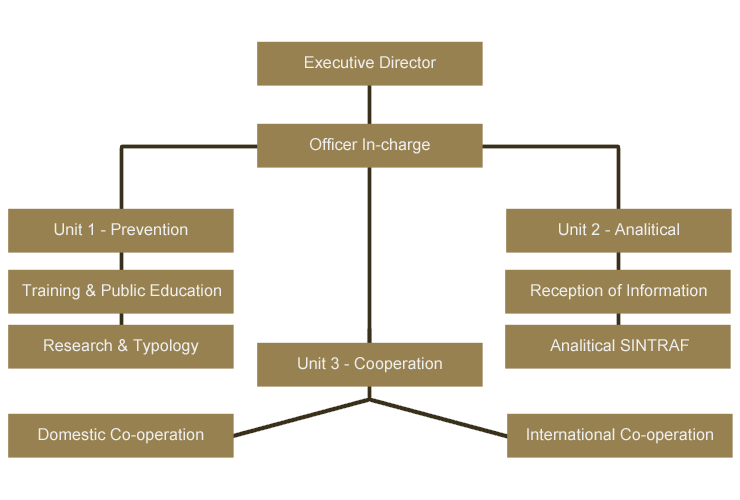

Organization

Competences

The Decree Law no. 16/2014 of 18 June sets out competences of UIF and are, between others, highlighted as follows:

This Unit is responsible mainly for receiving, request and analyzing information related to suspicious transactions reports provided by reporting entities and their relevant information concerning practice of ML and FT, and disseminating.

Whenever there is suspicion that a transaction is related to the commission of any type of offences provided in the Law, the FIU shall communicate to Public Prosecutor Office and collaborates with judicial authorities and other entities with competence in the prevention and combating ML and TF crimes. Part of UIF functions is to promote public raising awareness concerning topics related to risk of ML and TF.

The UIF may enter into cooperation agreements with foreign counterparts and judicial authorities including other entities with competence in the prevention of ML and TF.

Under article 20 of AML/CFT Law no.17/2011, all staff of FIU is subject to a confidentiality duty with respect to information to which they have had access in the performance of their duties, generating its violation disciplinary and criminal liability.

Cooperation

As provided in the article 11 of Decree Law no. 16/2014 the FIU has entered into cooperation agreements with national entities and international FIUs for institutional cooperation as follows:

- Domestic cooperation

- International cooperation (Unidade de Informação Financeira de Portugal (2015))

Frequent Asked Questions:

Definition of ML and FT?

ML and FT is an abbreviated term to describe “Money Laundering” and “Terrorist Financing”, it involves strategies and measures developed or under development process to combat ML/FT at both national and international level.

ML is a process used by criminals where the origins of money or assets generated as a result of criminal activity, can be concealed, and as a result, the proceeds lose their existing criminal identity and appear to have originated from a legitimate source. FT is where funds or other property is made available to terrorist or terrorist organisations, directly or indirectly, with the sole intention that the funds be used to further terrorism. The funds used may from legitimate and/or illegitimate source.

How money laundering processes take place?

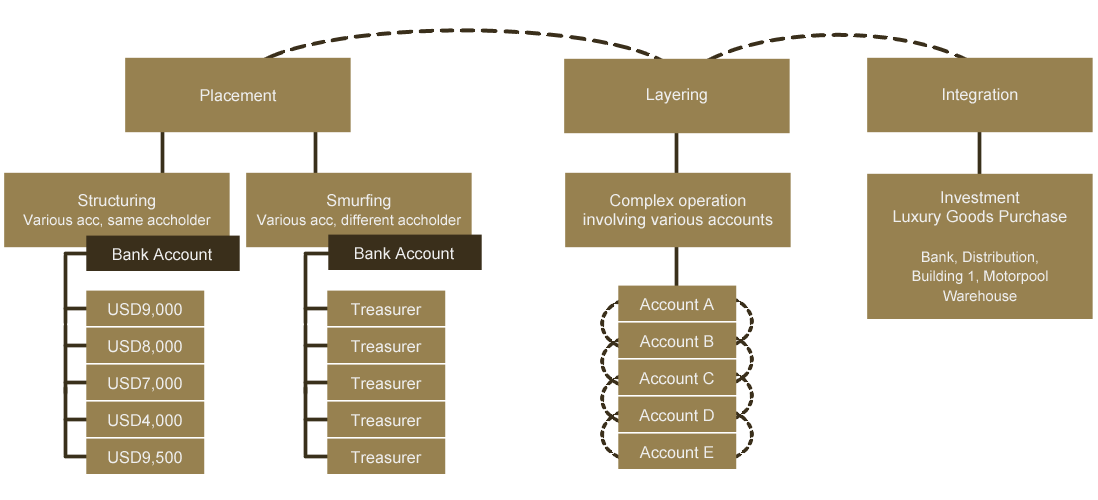

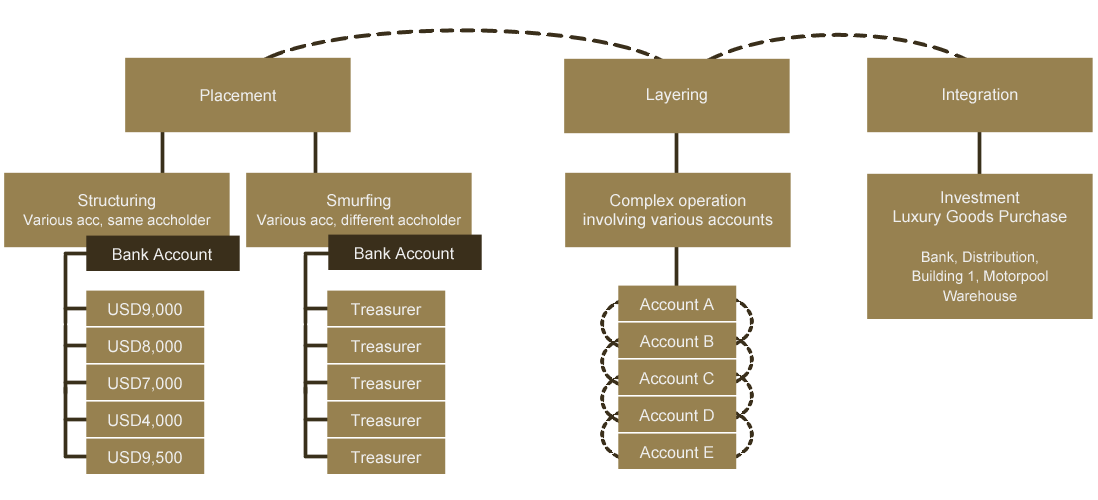

Basically the process of money laundering is divided into three phases:

Placement, the launderer introduces illegal profits obtained into the financial system and economic using financial institutions (banks, money changers, casinos, etc). This phase

consisted of restructuring (place fund in several accounts or assets of same owner) and smurfing (place fund in several accounts or assets of different owners)

Layering, the proceeds are converted or moved further from the original source by creating various layers between the sourced of fund and what is intended to achieve and making it appearing more legitimate.

Integration, the laundered proceeds are ultimately injected into a legitimate economy through purchasing luxury assets/properties, precious metals, etc.

Why ML and FT is considered crime?

The Penal Code criminalizes respectively in articles 313 and 133 ML and TF and is subject to imprisonment with a maximum limit of 12 years for ML and 25 years for TF offences.

Legal regime applicable to ML/FT?

Timor-Leste’s legal regime for prevention of ML and FT is Law no. 17/2011 of 28 December, amended by Law no. 3/2013/III of 14 de August.

How to combat ML and FT?

- Criminalize ML/FT and applicable fines

- Develop public raising awareness program to create national sense on the fight against ML/FT

- Supervisory authorities undertaking periodic oversight to verify compliance of reporting entities regarding obligation to implement preventive measures required under applicable rules. In the case of reporting entities within BCTL jurisdiction Instructions in force are: no. BPA/B-2003/3 on the opening and maintenance of deposit accounts; and n.º BPA/B-2004/2 on the prevention of money laundering, identification of customers and record keeping.

- The creation of FIU as a national centre for the receipt and analyse STRs including other relevant information and dissemination of the result of analysis, is an imp crucial measures, contributing to ML/FT investigation process.

- Strengthen cooperation between law enforcement authorities and other stakeholders.

Why the existence of UIF is essential?

- Implementation of FATF recommendations R.29 and Law no. 17/2011.

- Establishment of UIF is a national effort to combat ML/FT risks. The UIF is the central agency that receives suspicious transaction reports and other relevant information, analyse it and disseminate the result of analysis to Public Prosecutor Office, facilitating process of investigation related to ML/TF and other predicate offences.

What is a suspicious transaction?

A transaction is considered suspicious when (i) appears unusual and has no clear economic purpose; (i) the case where there is any suspicion or reasonable grounds to suspect that it involves money laundering terrorist financing or any proceeds from unlawful activity; (ii) involves complex transaction flows and unjustifiable.

Why filing STR to UIF?

Under article 23 of Law no.17/2011, all reporting entities if having reasonable grounds to suspect that a transactionappears unusual or involves money laundering and terrorist financing activity, they shall immediately report to UIF.

Dealers in precious stones and metals should also notify FIU of any suspicious transactions amounting 10,000.00 U.S. Dollars or above.

What is the due date for filing a suspicious transaction report to UIF?

All reporting entities shall immediately communicate a suspicion transaction to UIF.

Types of reports to UIF?

- Suspicious Transaction Reports (STR) – Obligation of all financial and non-financial institutions under article 3 of Law no. 17/2011

- Cash Transactions Reports (CTR) – Money Transfer Operators under article 13 of BCTL Instruction no 01/2013 of 27 September

- Traveller’s cash transportation declared in the Custom Form – Obligation of Custom Authority under article 7 of Law no.17/2011

Who are the reporting entities?

The financial and non-financial entities covered by Law no. 17/2011 are between others:

Banks/credit institutions; Micro-finance institutions; Insurance companies; Issuers and/or managers of credit or debit cards; Money Transfer Operators; Casinos; Lawyers (those who providing financial services on behalf of their clients); Accountants, independent auditors and tax consultants.

Who has the obligation to secure confidentiality of information provided to or requested by UIF?

-

The UIF employees are subject to a special duty of confidentiality as determined in the article 20 of Law no. 17/2011. They are also subject to code of conduct provisions provided in the Governing Board Resolution no. 32/2016 on the BCTL Employment Terms and Conditions.

-

The reporting entities, its employees and agents as required under article 25 of the same Law.

-

The same Law provides exemption of liability to reporting entities …”according to article 23-A, the disclosure of information in good faith shall not involve the disclosing party in liability of any kind, even if the suspicion is not confirmed”

What is a predicate offence?

A predicate offence is the underlying crime that generates the money to be laundered. The predicate offence is one of the material elements of money laundering offence, for example, authorities cannot punish an individual for laundering the proceeds of a tax evasion if it is not defined as a predicate offence. The Decree Law no. 19/2009 on the Penal Code, which criminalises ML sets out a list of predicate crimes for those crimes that carrying a minimum sentence of over 2 years imprisonment.

Breaching of obligations provided in the Law, would this subject to sanction?

Failure to comply with the obligations and duties or failure to observe the above procedures constitutes an administrative offense, punishable with a fine between 5,000 and 500,000 US dollars and possible application of sanctions ranging from simple written warning to suspension or prohibition of continued activity for a period of 6 months to 3 years.

Although the FIU is not a supervisory authority, this Unit can decide on the offenses and impose administrative sanctions to any legal or natural persons for which there is no competent regulatory agency to ensure compliance with the requirements provided in the Law no. 17/2011.

What is the fine for failure to report STR?

The non-compliance with preventive measures required under the Law in force include failure to submit STR to UIF shall be considered breaches committed intentionally or by gross negligence and are punishable with a fine ranging between 250.00 and 150.000,00 USD in the case of natural person, and ranging between 1.250,00 and 750.000,00 USD for a legal person.

What is a Political Exposed Person (PEP)?

Under article 1 of the same Law, PEP means the natural persons who are or have been entrusted until one year ago with prominent political or public functions, as well as their close family members and persons known to have close corporate or commercial relationships with them.

What is KYC and CDD?

KYC and CDD are the abbreviated terms to describe “Know Your Customer” and “Customer Due Diligence”.

KYC is the first step of preventive measures that reporting entities are obliged to perform all that they need to identify, document and validate the authenticity of the customer or who acting on customer’s behalf prior to any engagement for the purpose of understanding nature of business and activities involved and determining relevant risks.

CDD is a further step of preventive measures that permits financial institutions obtain more information of a new or existing high risk customer or who acting on customer’s behalf and periodically assess relevant risks.

What is the role of supervisory authority in the implementation of Law no. 17/2011?

The supervisory authorities are responsible for issuance of regulations and instructions to supervise andoversight compliance of financial and non-financial institutions against applicable legal requirements, application of sanctions for non-compliance, cooperate and exchange of information with competent authorities includes UIF, immediate communication to UIF of any suspicion or facts related to ML and FT practice.

What is the consequence of non-declaration of cash transportation or Bearer Negotiable Instrument (BNI) equal or above USD10,000.00?

Non-declaration or false declaration regarding transporting cash or BNI made by any person entering or leaving the territory of Timor-Leste, the Custom Authoritieswill seize it in part or whole of the amount transported and may be subject to applicable fines described in the article 32 of the same Law.

Who are FATF and APG?

-

The FATF (Financial Action Task Force) is an inter-governmental body established in 1989. The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system. This body has developed a series ofrecommendationsthat are recognised as the international standard for combating of money laundering and the financing of terrorism.

-

The APG (Asia/Pacific Group on Money Laundering)is an inter-governmental organisation founded in 1997 as the associate member of FATF, with itsSecretariat located in Sydney, Australia. The obligation of APG is to ensure that member countries within the region are universally adopts and implement FATF recommendations; providing technical assistance and encouraging cooperation and exchange of information between APG members; also undergoing a mutual evaluation to determine the level of compliance of the member with the international standards against money laundering and terrorist financing. Timor-Leste has officially joined the APG in July 2008.

What is MER?

MER is an abbreviation of Mutual Evaluation Report.

In 2011, Timor-Leste was subjected to the first mutual evaluation to verify its compliance with the 40+9 Recommendations, being the MER debated and adopted at theAPG plenary session held in Brisbane, Australia, in July of 2012. The MER adopted with a series of recommendations by member states in order to ensure Timor-Leste’s compliance of the mechanisms adopted with the FATF Recommendations.

What is CNCBC?

NCBC, a Portuguese acronym (Comissão Nacional para a Implementação das Medidas Destinadas a Prevenção e Combate ao Branqueamento de Capitais e ao Financiamento do Terrorismo) or a National Commission for implementation of AML/CFT measures, is a coordination mechanism constituted under the Government Resolution no. 10/ 2014 of 9 April. The Commission is tasked to coordinate the implementation measures/national policies for combating ML and FT in accordance with FATF Recommendations and requirements imposed by APG to its members. The CNCBC is co-chaired by the Ministers of Justice; and the Foreign Affairs and Cooperation, and a permanent Secretariat is placed within the Minister of Justice’s office.

What is Egmont Group?

The Egmont Group consisted of UIFs is an informal network which created in 1995 for the stimulation of international co-operation in the areas of exchange information, training and the sharing of expertise.